The Taxman Cometh: Researching in Tax Records

‘Tax lists’ is a term used to describe personal property tax lists, tithables, poll lists, land tax lists, and rent rolls, to name a few. Broadly speaking, these lists indicate the amount and kind of property owned by the taxpayer. At face value they don’t seem to be very helpful for genealogists, but when we look a lot closer, we can see how important they can be. They can place people in a certain place at a certain time, indicate relationship of individuals in a household and their approximate ages, and are often the only documentation that an individual lived in a certain place at a certain time, especially someone who didn’t own land. Just because you didn’t own land didn’t mean you weren’t taxed!

A couple of things to keep in mind regarding the importance of tax lists:

The census taker came every ten years and often missed people.

The tax collector came every year and seldom missed anyone.

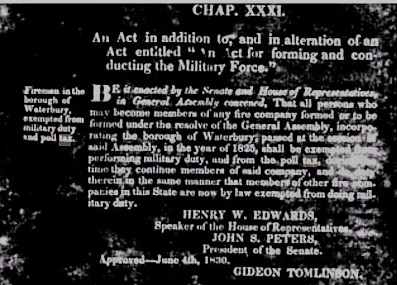

The first rule in tax record research is to know the tax laws of the time and place in which you are researching. Many published tax records contain explanatory material about laws governing taxation, so you should always read them before examining records.

Some important reasons why you need to know the tax laws of the time:

- At what age people were taxed. Were people taxed beginning at the age of 16, 18 or 21? Knowing this will tell you when to start looking at tax records. Another benefit of knowing laws regarding taxation age is that it’s possible to estimate the birth date of a person added to an established family group by subtracting 16 from tax year in which he first appeared.

- When people no longer had to pay taxes. Were they removed from the rolls at age 55, 65, or at death? You’ll know when to stop looking for them in tax records.

- Who did not have to pay taxes. Who was exempt from payment?

- Whether Indians, free blacks, or women were taxed. You’ll know whether to look for “minorities” on the tax rolls.

- Whether owners or renters paid tax on land or on slaves. You’ll know who was responsible for payment.

It can be tedious work to track the laws year by year in legislative records, but it must be done in order to properly analyze the tax lists. Our ancestors had to know the law, and so should their descendants. Fortunately there’s a great tool – Google Books – to help you with this:

- Go to google.books.com

- Enter search terms “[state name] + “tax” + “laws”

- At the top right, select “Any view”, then “Full view”

- From the same side, select “Any time”, then the time period. (18th c., 19thc., 20th c.)

Figure 1 shows a result from this search.

Another way find historic tax laws to visit the FamilySearch state wikis using this URL, replacing “[State]” with the name of your chosen state: https://www.familysearch.org/en/wiki/[State]_Taxation

Every type of record has its challenges, and tax records are no exception. Some examples include laws varying from one place to another; varying of content according to purposes for taxation and time period; fragmentary surviving lists; large numbers of records lost or destroyed; and difficulty reading or interpreting records.

So what kinds of information may be in these tax records? The content will vary according to time period, laws, and localities, but generally you can learn:

- Name and residence of taxpayer and eligible males

- Description of real property and its exact location, including water courses and acreage

- Slaves by age and classification

- Livestock (horses, cattle, sheep, hogs)

- Number of males 21 and over; those eligible to vote

- Number of children of school age and under

- Information about inherited real estate and its assessment

- Rate of assessment and taxes collected

Tax records can also be used to differentiate between men of the same name in the same county; to establish taxpayer’s death date based on the year in which his or her estate appeared on the tax rolls; and as a substitute for lost census records.

During the colonial period, taxpayers were called tithables. They were generally 16-60 years old and had to pay regardless of personal assets. Depending on local laws, males usually taxable at of 16, 18, or 21 through about age 50 or 60, with some exceptions for veterans, ministers, paupers, etc. Monies were used to pay to support a church minister or church wardens of parishes, build churches, support the poor, care for sick and infirm, supply food for the elderly and indigents, and bury paupers. These taxes were never levied in Pennsylvania because the ruling Quakers opposed the establishment of any official church, which was then the Church of England.

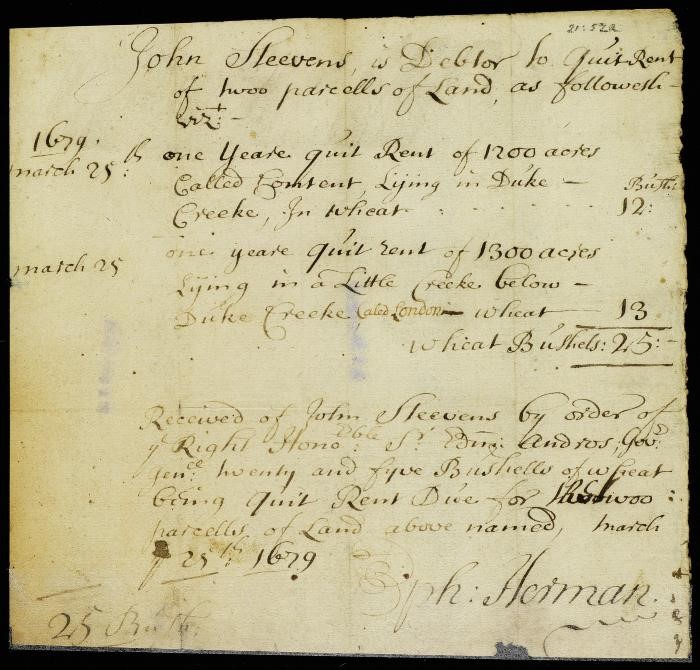

The tax known as the quitrent was a land tax imposed on occupants of freehold or leased land instead of services to a higher landowning authority. The yearly amount of money was paid generally at a rate per each 100 acres of land. It usually started several years after the owner had settled on property, and was later abolished at the start of the Revolutionary War. Figure 2 is an example of a quitrent record.

Tax processes also varied from place to place. For example, Virginians turned in list of tithables, or taxable individuals, for whom they would pay tax. Heads of household in Massachusetts turned in lists of personal and real property that were copied into tax books. Marylanders and South Carolinians had to give information about the number of acres owned as well as a memorial (statement identifying former owners and how and when the current owner came to possess that land). If the tax official was unable to collect, he usually made a list and sometimes gave a reason for non-collection (taxpayer moved, died, was too old, etc.)

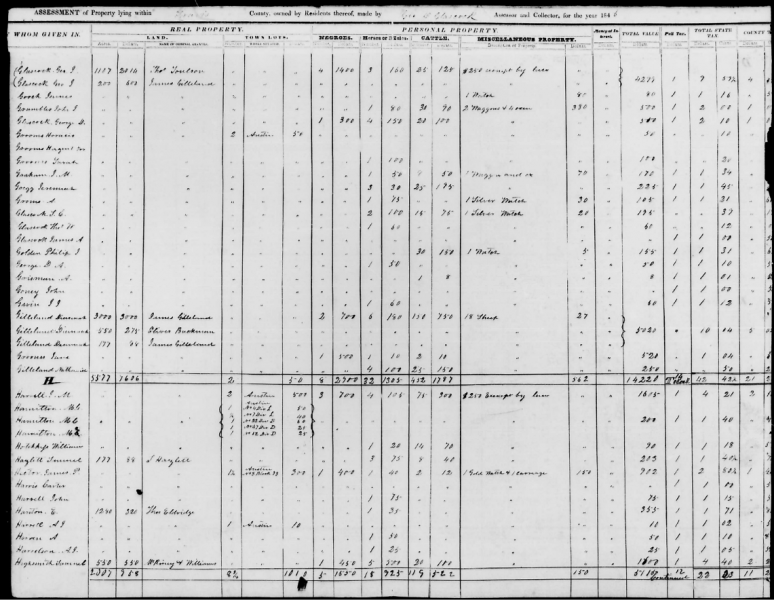

Types of commonly found tax records include poll, land, personal property (household items, livestock, slaves), federal, and inheritance/estate. Personal and real property taxes are ones that genealogists encounter most, but other kinds may also exist for your locality. Figure 3 is an example of a personal property tax list. These lists can give you an idea of a person’s personal wealth, as they show the number and value of items such as carriages, clocks, gold and silver plate over $50, and pianos.

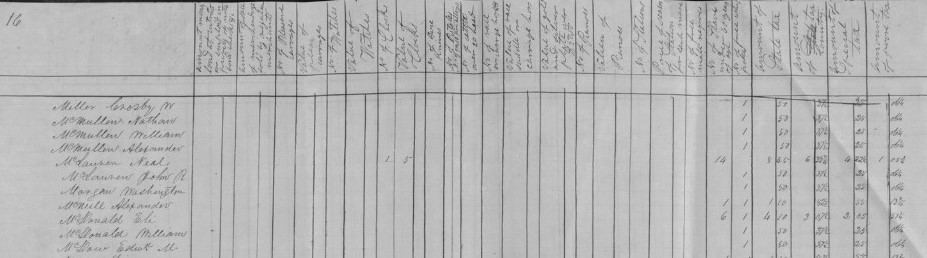

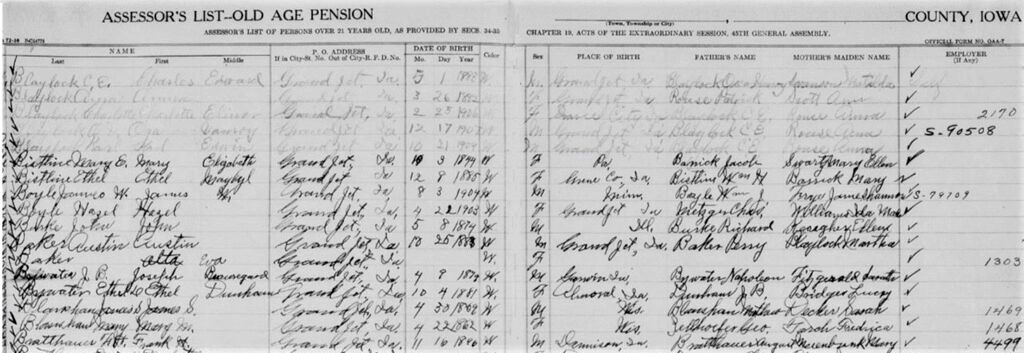

Miscellaneous taxes you may encounter include militia, road order, faculty, business licenses, liquor, school, federal head taxes on immigrant aliens, and old-age assistance taxes. Not all of these records survive, but regarding the old-age assistance tax, FamilySearch has digitized those from 38 Iowa counties between 1934 and 1958. Persons listed were those who paid the tax, not those who received the funds. The information can include the taxpayer’s name, date the tax was paid, place of birth, parents’ names, and home address (Figure 4). The records can include Iowa settlers who may not appear in other birth records.

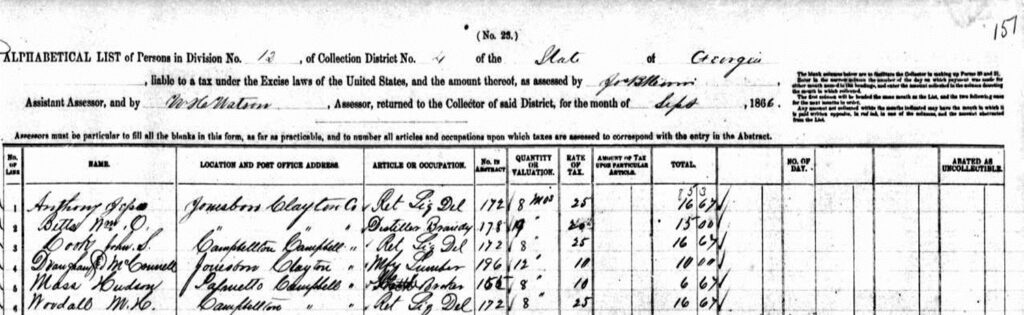

An example of a federal tax record is the collection of Internal Revenue Assessment Lists, compiled between 1862 and 1874 and listed in the Locality Search of the FamilySearch Catalog under the state, and under the state, under “Taxation”. Arranged by state and collection district, they are the result of the Internal Revenue Act of July 1, 1862 which authorized the collection of monthly and annual taxes on goods, services, licenses, income, and personal property in order to raise money for the Civil War (Figure 5). Years of coverage vary between states.

There are many on-line resources to help you locate and view various tax records:

- FamilySearch Catalog with search terms “[Place]” and once you’re on that page, look for the term “Taxation.

- FamilySearch State Wiki

- Ancestry.com or Ancestry Library Edition in the Genealogy Room. On the home page, scroll down to “Tax, Criminal, Land & Wills”, select “Tax Lists”, then “USA”. Currently this results in 55 databases in catalog. Remember that in the catalog that “tax” not always in the title, so a search on “tax” may not bring best results.

- Cyndi’s List – Taxes and The Ancestor Hunt are great portals to on-line tax records.

- At USGenWeb, try a search on “tax” on the state or county page if it has search capability. Tax records may have been uploaded.

A great all-around way to find digitized tax records is to use Google. Enter the search terms “digital + tax + lists + [location]”. One such search revealed the following collections:

Tax Lists and Records – North Carolina Digital Collections

Property Tax Records for Baltimore City

Mississippi County Tax Rolls, 1818-1902

Use these great tax-finding tools to add more breadth and depth to your family history. You will probably be happy that the taxman cameth.

Recent Comments